Our Investment Philosophy

At Finclusive Ventures, we invest in early stage founders. We are often asked how we invest and how we value-add. So we thought we’d break it down for you.

What We Look For:

There are many ways to invest, but each investment strategy must be tailored to the specific investor. We understand that each firm’s investment philosophy grows and develops over time. At Finclusive, we look for the following:

1. Growing Market. Is there a potential for your company to achieve at least $1B some day? Do you know for sure? How do you know? Many people believe it should be founders first and we mostly agree too, but if the market is not big enough, no matter how awesome your product or service is, or how awesome your team is, there won't be room for you to grow or pivot if the market changes. Sometimes we don't see the market immediately, so it's up to the founder to deeply understand and communicate what the market is for their vision to the world.".

2. Gritty Team. We invest in people we want to work for. Through my experiences in Delivering Happiness, we see the power of culture and how it emanates from the founding team. Who do you attract to work for you? What lessons and insights have you learned? How do you confidently find and determine "market signal"? How do you design and test experiments? Founders that thoughtfully build a company of values often create a more committed team, leading to tighter feedback loops and quicker execution. We look for gritty founders who can pivot quickly. It’s okay that you don’t know everything, but you have to be faster learners. Be transparent with us about what you don’t know, so we can help find those answers with you. You meet failures throughout your entrepreneurship journey, but failures are code for learning. Collect them and do it again.

3. Useful Product. Do people actually love your product? Are you driving 10x improvement in efficiency, quality, cost or a combination of the above? Or are you just really good at doing ads to get your metrics up? Who's your best customer(s)? How do you define them? How do you grow and retain them? How does your product strategy support network effects? (e.g., land and expand, intrinsic viral and platform effects). We want to invest in products that people actually need. We interview your users or actually become one of your users!

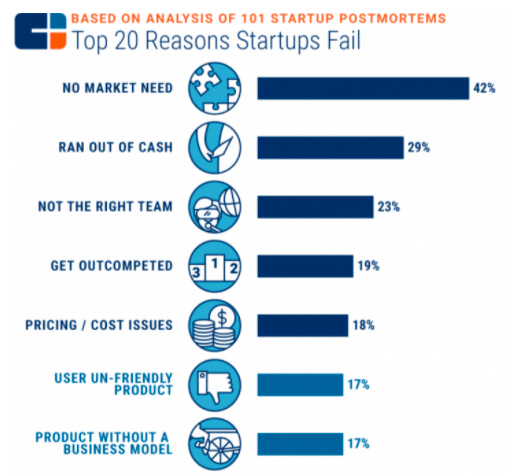

The #1 reason a startup fails is because there’s no real market need. We need to see evidence of real market-product-fit. Learn how Calendly did this.

4. Fair Valuation. We refrain from investing due to FOMO. This is why we try to speak with teams early, before they need to raise. If the company is already generating significant hype, it’s possible our return profile will be diminished amid skyrocketing valuations. How high is too high? It’s hard to say, as it depends on the sector. But it could stand to reason that the more exposure a strong company receives, the more likely it is being overvalued. Therefore, our secret sauce lies in our ability to spot potential, even when our peers may not agree.

Horizontal Focus

In summary, we want to invest in the best startups around the world at a fair value and help them create additional value. While investing in diversity is our “thesis”, we know in reality that it should be part of every firm’s thesis. This is still a competitive advantage now, because a lot of investors still don’t believe that diversity is good for business, and therefore miss out on opportunities.

Vertical Focus: People Planet Profit

We invest in what that we know and sectors that are really humanity focused—anything that creates a more financially inclusive and equitable world. Thematically, we invest in startups that have a clear focus on improving the quality of life of all humanity -- building dreams and healing pains -- with the following focus:

1. People (Future of Work & Education)

“Deep work is love made visible.”

We believe that we are all here to learn from one another and contribute to the greater community. We are at a juncture where we can reimagine how we work and learn. The market is massive, with potential verticals that don’t even exist yet. Here’s a future of work thesis by Brenda Campbell and myself.

2. Planet (Climate Tech)

Toward the end of my engineering career, I specialized in sustainability management. I was a LEED AP as well as a certified sustainability manager. There is no single threat greater than our climate crisis right now. However, the opposite of danger is opportunity -- that’s how you write crisis in Chinese: 危機 (danger + opportunity).

Change starts with awareness, and we believe innovation is the solution to the crisis of our lifetime. We invest in companies that reduce carbon emissions in Food Tech, AgTech and Clean Tech. Here’s a thesis Ali and I put together with another partner on the Future of Food and Agriculture. Also suggest checking out At One Ventures.

3. Profit (FinTech)

There are many ways to deploy capital. At Finclusive, we believe capital is a means to unlocking opportunities for all, and technology is the mechanism enabling more efficient allocation of this resource. Our financial infrastructure, which historically has worked for the few, is currently undergoing massive disruption towards democratization. For more, refer to the Democratization of Illiquid Assets thesis by our Venture Partner Andrew Gonzales and John Walsh. We also love this thesis on Payments by our friends Uma Sinha and Suzanne Ley.

Where We Add Value

People often talk about the tenants of “smart money”. Being a VC is the combination of a coach and an investor. Giving someone money is saying “I believe in you” and a coach’s job is to get others to believe in themselves. The following are areas where we add value for our founders:

1. Fundraising. We are committed to help our founders fill rounds with our network, regardless of how much we invested ourselves. We believe that founders are supposed to be focusing on what they do best: building companies.

2. People: Partnership & Hiring. With our networks in cities around the world, we can make introductions as needed. My partner GP, Ali Baxter, has particular experience in brand partnership. I’m experienced in engineering and ops development. When you start to scale, all the problems facing a startup multiplies. We can advise you on designing your organization growth. If you can attract your candidates, we can help you decide and close them. Many of our venture partners are previous or current operators. We can’t drive for you, but we can show you the way.

3. Coaching and Advising as needed. We practice executive coaching, which involves a series of inquiries to help you come up with your own solutions. We ask you thoughtful questions and help you consider all your options, especially the ones you don’t see.

4. Helping companies that we may not invest in. We offer office hours publicly (currently on Clubhouse) and are developing content (our podcast and this newsletter) to help both founders and investors. We also volunteer as speakers and judges at startup events or coaches in accelerators. We do this because 1) we want to meet founders early, and 2) we believe entrepreneurship is the highest form of creativity in business. However, due to our current bandwidth, we don’t offer 1 on 1 coaching for founders unless we have invested or are very close to investing.

We hope this helps you better understand our investment philosophy. We hope to hear from you — tell us about what you are building here.

Stay GRITTY,

Kelly Lei

GP of Finclusive Ventures